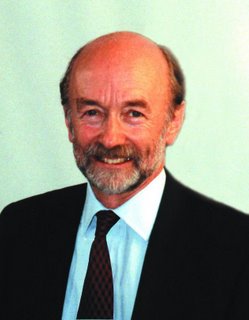

Come January 23 - 25 2006 at the Muscat Inter-Continental Hotel, Mark Eaton will present on Lean Enterprise at PEIE’s annual Smart Manufacturing Conference. In this in-depth, no holds barred interview, Eaton, a veteran design engineer, and former Director of the UK’s Department of Trade and Industry’s Manufacturing Advisory Service, shares with us his thoughts on a range of manufacturing issues.

Come January 23 - 25 2006 at the Muscat Inter-Continental Hotel, Mark Eaton will present on Lean Enterprise at PEIE’s annual Smart Manufacturing Conference. In this in-depth, no holds barred interview, Eaton, a veteran design engineer, and former Director of the UK’s Department of Trade and Industry’s Manufacturing Advisory Service, shares with us his thoughts on a range of manufacturing issues.PM: How do you see manufacturing changing over the next 20 years?

Obviously, it is now possible to theorise about the worldwide impact of the growth in the Chinese economy and the stress it will place on global competition. I would also anticipate the continuing rise in the importance of brands in high-end manufacturing, both at the business and national level. I foresee the consolidation of low-end manufacturing into fewer, more specialised manufacturers who will offer flexibility and extremely high levels of productivity.

I also predict that increasing globalisation will have the impact of increasing the number of Small and Medium Enterprises (SMEs) who chase low costs around the world, but are currently prohibited by the extreme costs involved. Within a little more than 20 years, I anticipate we will need to find new ‘emerging markets’ as the costs in China, India, even Eastern Europe will begin to reach a level where it is uneconomical to outsource to them. Throughout this period, niche businesses will continue to thrive by providing differentiated, flexible services at higher costs.

PM: Which emerging technology do you think has the most potential to change manufacturing?

You can't answer a question like this without first referring to the impact of the wireless communications and the continuing growth in the Internet, on all aspects of manufacturing - from machine measurement through to supply chain planning. A secondary technology that will have an impact will be RFID (radio frequency identification) with its applications in everything from product tracking to national security.

In terms of the new sectors that will impact on manufacturing, these are unequivocally micro/nano technology and bio-processing, all of which will make a major impact on the world. Due to the investment barriers to entry in the market, these will make it difficult for companies to break into in the medium term unless they consider their entry strategy in the very near future.

PM: What about the issue of knowledge transfer from academia to industry?

The amount of research capability in academia far outstrips that is available in industry and there is an urgent need in many economies to make this research more accessible to industry; also to significantly simplify the process of working with academia. I have been deeply impressed by the Fraunhofer Institutes (http://www.iis.fraunhofer.de/index.html) that originated in Germany and how they are both accessible to industry and focused on the commercialisation of research.

PM: Should universities become more responsive to the needs of manufacturing?

I would agree that for many manufacturers the processes of accessing and then forming a relationship with universities has been very difficult - often caused by the different needs of the organisations concerned. There have been a number of attempts to simplify the process of getting access to universities and making them more responsive, including introducing layers of intermediaries. But there are still some major problems to overcome before universities are as responsive as they need to be to support industry effectively.

PM: What type of involvement would you like to see manufacturers have with universities?

Universities are fundamentally clusters of knowledge. Virtually no manufacturer could afford to have research capabilities as big as those held within even a single university. I would be delighted to see universities starting to become an integral, but outsourced, part of the R&D functions of organisations. I don’t just mean large manufacturers. This may mean that different funding models need to be used such as deferred payments or universities taking a percentage of future sales without requiring funding upfront.

PM: What are the common principles that guide the best manufacturers?

The most prevalent measures of success in manufacturers around the world appear to be having an appropriate culture that supports the aims of the business: whether that is to be the most innovative, lowest cost, fastest turn-round etc. For many manufacturers, relationships with customers and suppliers are also key and the formation of effective partnerships is going to be a major source of competitive advantage in the coming years. In addition to these internal factors and skills, governmental policy and regional trading conditions need to be monitored and reacted too accordingly and the best organisations are adept at keeping close to the external factors that affect the internal operations of their business.

PM: Anybody can buy the latest, greatest equipment, but manufacturing isn’t a purely mechanical system. It's the "people systems" that determine a plant's productivity. How does a manufacturer build the necessary “people systems”?

For all but the most automated factories, people are the essential variable that will make every product, fix every problem and identify every improvement. Without ‘people engagement’ no business can hope to be a success. But how you engage them is recognised as one of the most difficult issues faced by senior management and changing culture one of the most difficult and time-consuming change processes. There is no general solution to how you build the necessary people systems. It is a function of where the business culture and systems are today and where the business managers want business to move to and then planning the improvement roadmap. Wherever the organisation starts from the solution will include such things as policies, procedures, management style, measurements, communication and reward/recognition systems.

PM: We all think that the faster a plant can make a quality product, the less that product costs to produce. Those savings can be applied to new features. That's how you become more competitive, sell more products, increase profits and ultimately improve job security. Is this how manufacturing works in the real world?

This is a common misconception and the cause of many businesses going out of business. Doing things faster often implies throwing extra effort and resources at it and these carry extra costs. In addition, making things faster that you have not - or cannot - sell means wasting money faster too. Going ‘faster’ often drives people to build bigger batches of products to avoid costly set-up times which would slow things down. This means producing things that cannot be sold immediately which ties up significant cash and space. A better approach is to focus on shortening change-over times so you can run smaller batches and remove non-value adding activities so the business is more responsive. The benefit is that your productivity and flexibility will increase making it easier to cope with what the world will throw at you.

PM: Dell hit in excess of US$45 billion in annual revenue and is growing at nearly 20 per cent yearly. It seems well on its way toward surpassing its goal of US$60 billion within the next few years. To get better faster, it intends to slash US$2 billion in costs. It is indicated that much of the cuts will come from manufacturing operations and the supply chain. Is speed the ultimate competitive weapon?

Responsiveness is an effective weapon for many manufacturers, but not all. It is important for manufacturers to understand the key drivers in their markets – what are the market leaders doing? What do the customers value? The best weapon is to have a clear understanding of the competitive factors that drive the sector each company operates in – looking externally at what is required rather than internally at what is offered!

PM: Do small manufacturers need big-name supporters?

Many small manufacturers have difficulty managing larger suppliers in their supply chain and I believe there will be a continuing move toward purchasing clusters to allow smaller companies to leverage cost savings and improvements in responsiveness from larger suppliers. In wider terms, many smaller companies can be highly successful without big name supporters, especially in niche markets or for markets where the customers are ‘brand insensitive’ - as in they are not worried by brand value. Perhaps, the best big name supporters of smaller companies will be banks and the media and for many these should be the ones to ensure you have a good relationship with.

PM: Whether you're running a manufaxturing outfit with 3 or 3,000 people, you have to hire the best engineers, the best marketers and the best production workers. The products you make, the programs you have, the mission you espouse should make people feel good about working for you. In your view, are corporate values a real motivator?

In the first instance, I would like to challenge the assumption that you always need to hire the best, implying the most expensive. Misquoting Toyota, we get; “we produce excellent results from average people with excellent processes. Our competitors get average results, with excellent people and broken processes.” This statement says that a well organised (and lean) manufacturer will inherently be more effective than an organisation with any number of excellent people but with ineffective processes.

Answering the second part of the question, in a competitive situation where manufacturers are trying to attract talent and there are numerous options for the individual, then the decisions come down to which organisation best meets the personal needs of the individual. Some of these needs will be logistical (closeness to where they want to live, working hours that fit their lifestyle needs etc) and some will be emotional (values of the business, working environment, appropriate opportunities for advancement etc). The most effective manufacturers will aim to achieve the best fit between the needs of the business and the logistical and emotional fit of the individual.

PM: What do you do when the business world as you've always known it simply ceases to be? When new competitors and new technologies explode the industry economics? When everything that worked before won't work - and can't work ever again?

It is difficult for manufacturers to recover from a major fracture in the market and this is where there is a need to have good external scanning processes to try to predict major changes in the market in a timely manner. However, using a metaphor, whilst we have the technology to spot large asteroids that are likely to hit the Earth, there is a chance we will miss one, and one is all it takes! Therefore, in a market where the world has changed, the winners will be those who can evolve fastest, the most innovative manufacturers with the ability to quickly restructure their finances and operations to meet the new challenge.

If we don't have to own it, let's not own it. And if we do have to own it, let's reduce the risk by sharing it. How does this kind of thinking apply to today’s manufacturing sector?

There have been attempts to share resources and workforces (particularly in areas where the skills are difficult to access) and there are manufacturers who have recognised that one company’s waste is another’s raw material but these are in a minority at present. For many companies, forming trading partnerships to share resources will be an effective way of reducing risk, but the key issue is finding the right partner to link with. In the UK, this is being addressed by PSL (Partnership Sourcing Limited - http://www.pslcbi.com) who are a not for profit orgnisation originally established by the UK government and who are now leading the development of the new ISO standard (11000) which will cover how to effectively partner.

PM: If we can't dominate a category, let's get out. Is this smart thinking?

The answer to this is to look at the Boston Consulting Group matrix. If the market is low growth and you hold a low share (what is termed a ‘Dog’), then it may be best to plan an exit strategy, but if the market is growing and the company holds a low share (a ‘Question Mark’), then the organisation has options based on the competitive situation in the market. If the market looks likely to consolidate around one or two major players then it prompts one exit strategy (possibly holding out to be bought out). Lastly, if the market looks like it will support numerous suppliers, it may be prudent to hold your nerve and stay with it. The answer therefore is not simple and will need to be thought through by the business.